Introduction to Bankruptcy and the Elderly

Financial hardship happens to the best of us. There is no age group that is safe from financial hardship. Despite any other factor, like age or education, bankruptcy is an option for everyone – even small and big businesses. One age group that has seen an increase in the amount of bankruptcies filed is the elderly. Between the years 1991 and 2001 the rate of personal bankruptcies filed by people 65 years or older jumped up 150%.[i] When it comes to senior citizens, there are a lot more factors to consider that younger age groups may not have to worry about just yet including retirement accounts and Social Security Income. However, there are a lot more benefits allotted to the older generations of people when it comes to filing for bankruptcy.

Financial hardship happens to the best of us. There is no age group that is safe from financial hardship. Despite any other factor, like age or education, bankruptcy is an option for everyone – even small and big businesses. One age group that has seen an increase in the amount of bankruptcies filed is the elderly. Between the years 1991 and 2001 the rate of personal bankruptcies filed by people 65 years or older jumped up 150%.[i] When it comes to senior citizens, there are a lot more factors to consider that younger age groups may not have to worry about just yet including retirement accounts and Social Security Income. However, there are a lot more benefits allotted to the older generations of people when it comes to filing for bankruptcy.

Major Causes for the Elderly to File Bankruptcy

One of the major causes of bankruptcy with a lot of age groups, but especially with the elderly are medical bills and expenses.[ii] Medial bills and expenses are one of the easiest debts to discharge in any bankruptcy proceeding.[iii] Any medical bills that exist at the time the bankruptcy petition is filed, for Chapter 7 or Chapter 13, are the only bills that will be considered during the bankruptcy proceeding.[iv] Any medical bills that are accrued after the proceeding has started, or shortly after the proceeding has ended, will not be included in the bankruptcy petition.[v]

If a person wishes to include later accrued medical bills in a subsequent bankruptcy petition and seek for those debts to be discharged, the debtor must wait. If the debtor wants to file for Chapter 7 bankruptcy, the debt has to wait eight years before that type of bankruptcy can be filed again.[vi] If the debtor wants to file for Chapter 13 bankruptcy, the debtor must wait two years.[vii] Typically, a bankruptcy attorney will recommend that an individual hold off on filing if they are aware of any upcoming medical bills that they would like to have included in the bankruptcy petition – that way all the bills can be wiped out together through the discharge.

Which Bankruptcy Option is Better for the Elderly – Chapter 7 or Chapter 13?

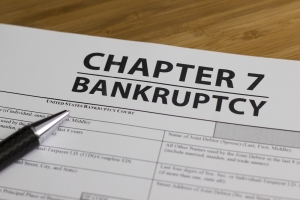

When it comes to filing bankruptcy there are a number of options an individual can take but there are two primary options that people choose to use. These are Chapter 7 bankruptcy and Chapter 13 bankruptcy. Chapter 7 bankruptcy is commonly referred to as the “clean slate” bankruptcy. This is because during the bankruptcy proceeding, the trustee that has been assigned to the debtor’s case will liquidate all property that is not exempt.[viii] The trustee will then use the proceeds to pay off as much of the debtor’s debts as they can. Then, once the proceeding comes to an end, the judge will discharge the remaining debts and the debtor will be able to have a fresh start.

Now, it is important that the laws for bankruptcy permit the debtor to have exempt property otherwise the debtor will have no assets at all. With the help of exemptions, the debtor will be able to keep some basic assets.[ix] The exemptions will vary greatly depending on each state, but with only so much variation. Typically a person be able to have exemptions for their home, vehicle, basic furniture needs – like one chair per adult in the living room and one bed – and a set value for your wedding rings.[x]

Before the exemptions come into play, the debtor must meet all the eligibility requirements for filing a Chapter 7 bankruptcy. First of all, the debtor’s income cannot be over a certain amount.[xi] If the debtor’s income is above the amount provided for the court, the debtor can still attempt the means test to see if they can qualify through that route.[xii] Generally, if the debtor has enough income to pay off the debts and is just living without a lot of extra disposable income – then they are unlikely to qualify for Chapter 7 bankruptcy.

Before the exemptions come into play, the debtor must meet all the eligibility requirements for filing a Chapter 7 bankruptcy. First of all, the debtor’s income cannot be over a certain amount.[xi] If the debtor’s income is above the amount provided for the court, the debtor can still attempt the means test to see if they can qualify through that route.[xii] Generally, if the debtor has enough income to pay off the debts and is just living without a lot of extra disposable income – then they are unlikely to qualify for Chapter 7 bankruptcy.

For those who do not meet the income requirement for Chapter 7 bankruptcy must pass the means test. This test looks at a time period of six months for income and bills for the debtor.[xiii] If after all the calculations are complete for that particular person, if their current monthly income is less than the median income for a household of the debtor’s size in the debtor’s state, then the debtor will pass the means test.[xiv]

One thing that is a concern for the elderly going through financial hardship is whether or not their social security income will be considered part of their income. This is crucial not only for the means test, but for generally filing for Chapter 7 bankruptcy. Fortunately for those receiving social security income, it is not considered apart of the debtor’s income for the purposes of the means test.[xv] This is great news for elderly individuals who are in financial hardship and want to pursue Chapter 7 bankruptcy. Social Security Income is generally start being used by individuals between the age of 62 and 70 – even though it is possible to access the funds earlier.[xvi] The use of Social Security Income is to help supplement any retirement funds or retirement accounts an individual has.[xvii] The fact that Social Security Income is not calculated into the income for the means test of Chapter 7 bankruptcy proceedings is a type of proof that the bankruptcy system is trying to protect the elderly.[xviii]

Chapter 13 Bankruptcy for the Elderly

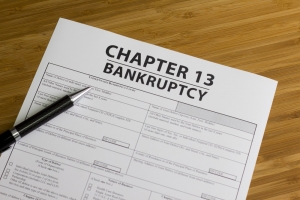

If the debtor seeking bankruptcy is unable to be approved for Chapter 7 bankruptcy, they will have the option of pursuing Chapter 13 bankruptcy.[xix] Chapter 13 bankruptcy does not provide a clean slate right away the way that Chapter 7 bankruptcy does, but it still can help those in financial need who have more income than Chapter 7 bankruptcy will allow. Chapter 13 bankruptcy reorganizes the debtor’s debts and creates a repayment plan for the debtor to follow for three to five years.[xx] The court will take the debtor’s income into consideration with this type of bankruptcy as well. Again, Social Security Income will not be taken into consideration for determining this income.[xxi] After the three to five years, depending on the repayment plan of the debtor, the charge will discharge any remaining debts.

If the debtor is unable to complete their repayment plan for any reason, like they lose their job or have an unforeseen change in income, the court can reconsider the repayment plan and adjust accordingly so that the debtor can continue.[xxii] If for any reason the debtor just stops paying their debts through the repayment plan, even if it is the last payment, the court may determine that they are not going to discharge any of the remaining debts for the debtor’s failure to comply with the entire repayment plan.[xxiii]

If the debtor is unable to complete their repayment plan for any reason, like they lose their job or have an unforeseen change in income, the court can reconsider the repayment plan and adjust accordingly so that the debtor can continue.[xxii] If for any reason the debtor just stops paying their debts through the repayment plan, even if it is the last payment, the court may determine that they are not going to discharge any of the remaining debts for the debtor’s failure to comply with the entire repayment plan.[xxiii]

Another thing that the court will look at before discharging any debts with Chapter 13 bankruptcy is whether or not the debtor is up to date with their alimony payments and child support.[xxiv] Alimony payments have the ability to last for an incredibly long time, so it is possible that even an elderly person will still be responsible for these payments. Child support only lasts until the child is eighteen years old, but if the parent responsible for those child support payments is not current on payments – the responsibility does not go away when the child turns eighteen. The missed and late child support payments just pile up and become a bulk debt that the responsible parent has to pay off eventually. Child support payments are not dischargeable in any type of bankruptcy.[xxv]

Other Types of Exemptions that Affect the Elderly

There are other property items that are protected through exemptions that affect the elderly more than other individuals. First of all, every state has an exemption for homes – the homestead exemption.[xxvi] The homestead allowance given to the elderly is on average higher in every state, as an added protection for the elderly group.[xxvii] Another type of property that is not included in the bankruptcy proceeding is retirement accounts.[xxviii] Even though many people start retirement accounts in their twenties, the amount of money that accumulates by time that same person reaches an elderly age – can be substantially more than the initial amount. Under the federal bankruptcy law, the tax exempt retirement accounts such as 401(k)s, 403(b)s, profit-sharing, money purchase, and defined-based plans, are completely exempt in bankruptcy.[xxix] IRAs and Roth IRAs are also protected up to $1,245,475.[xxx] This number adjusts every three years.[xxxi]

Conclusion to Bankruptcy and the Elderly

Financial hardship can hit anyone, no matter what their age is. When it comes to the elderly, there are a few more considerations that come into play when filing for bankruptcy. These include whether or not Social Security Income will be included as the debtor’s income, whether or not the debtor’s retirement accounts will be protected through exemptions, and if their home will have be sold during a Chapter 7 bankruptcy. Luckily for the elderly, when it comes to bankruptcy there are more protections put into place to protect assets like all listed above.

Financial hardship can hit anyone, no matter what their age is. When it comes to the elderly, there are a few more considerations that come into play when filing for bankruptcy. These include whether or not Social Security Income will be included as the debtor’s income, whether or not the debtor’s retirement accounts will be protected through exemptions, and if their home will have be sold during a Chapter 7 bankruptcy. Luckily for the elderly, when it comes to bankruptcy there are more protections put into place to protect assets like all listed above.

[i] See Bankruptcy hits Seniors the Hardest. Clark & Washington Attorneys and Counselors at Law LLC. (Published June 12, 2015). http://www.cw13.com/category/bankruptcy/

[ii] See Senior Citizens and Bankruptcy. NOLO Legal Encyclopedia. (Accessed May 20, 2016). http://www.nolo.com/legal-encyclopedia/senior-citizens-bankruptcy-should-elderly-file.html

[iii] Id.

[iv] Id.

[v] Id.

[vi] See Multiple Bankruptcy Filings: When Can You File Again. NOLO Legal Encyclopedia. (Accessed May 18, 2016). http://www.nolo.com/legal-encyclopedia/multiple-bankruptcy-filings-when-file-again.html

[vii] Id.

[viii] See A Chapter 7 Bankruptcy Overview. NOLO Legal Encyclopedia. (Accessed May 18, 2016). http://www.nolo.com/legal-encyclopedia/chapter-7-bankruptcy-overview-29571.html

[ix] See Bankruptcy Exemptions: An Overview. NOLO Legal Encyclopedia. (Accessed May 18, 2016). http://www.nolo.com/legal-encyclopedia/bankruptcy-exemptions-overview.html

[x] Id.

[xi] See Chapter 7 Bankruptcy – Who Can’t File

[xii] Id.

[xiii] See The Bankruptcy Means Test: Are you Eligible for Chapter 7 Bankruptcy? NOLO Legal Encyclopedia. (Accessed May 18, 2016). http://www.nolo.com/legal-encyclopedia/chapter-7-bankruptcy-means-test-eligibility-29907.html

[xiv] Id.

[xv] See Senior Citizens and Bankruptcy. NOLO Legal Encyclopedia. (Accessed May 20, 2016). http://www.nolo.com/legal-encyclopedia/senior-citizens-bankruptcy-should-elderly-file.html

[xvi] See Retirement Planner: When to Start your Benefits. Social Security Official Social Security Website. (Accessed May 20, 2016). https://www.ssa.gov/planners/retire/applying1.html

[xvii] Id.

[xviii] See Senior Citizens and Bankruptcy. NOLO Legal Encyclopedia. (Accessed May 20, 2016). http://www.nolo.com/legal-encyclopedia/senior-citizens-bankruptcy-should-elderly-file.html

[xix] Id.

[xx] See An Overview of Chapter 13 Bankruptcy. NOLO Legal Encyclopedia. (Accessed May 20, 2016). http://www.nolo.com/legal-encyclopedia/chapter-13-bankruptcy-overview-30099.html

[xxi] See Senior Citizens and Bankruptcy. NOLO Legal Encyclopedia. (Accessed May 20, 2016). http://www.nolo.com/legal-encyclopedia/senior-citizens-bankruptcy-should-elderly-file.html

[xxii] See An Overview of Chapter 13 Bankruptcy. NOLO Legal Encyclopedia. (Accessed May 20, 2016). http://www.nolo.com/legal-encyclopedia/chapter-13-bankruptcy-overview-30099.html

[xxiii] Id.

[xxiv] Id.

[xxv] Id.

[xxvi] See Bankruptcy Exemptions: An Overview. NOLO Legal Encyclopedia. (Accessed May 18, 2016). http://www.nolo.com/legal-encyclopedia/bankruptcy-exemptions-overview.html

[xxvii] See Senior Citizens and Bankruptcy. NOLO Legal Encyclopedia. (Accessed May 20, 2016). http://www.nolo.com/legal-encyclopedia/senior-citizens-bankruptcy-should-elderly-file.html

[xxviii] Id.

[xxix] Id.

[xxx] Id.

[xxxi] Id.